My goal is to help companies on the path to going public use this time to develop a playbook that will build lasting partnerships with public investors

Going public and crossing from private to public markets is a step that fascinates me. Numerous IPOs or, more recently SPACs, have started trading at their offering price but soared or crashed in subsequent months. What dynamics are at play? I believe one of the biggest may be the shift to a public market investor base that sees its investments marked to market each day (from a private investor base that doesn’t).

Acknowledging that few companies are going public right now, it takes quarters of planning to go public. Investment bankers help during the IPO process but, after that, companies can find themselves more or less on their own to build and tell their story. So, this article is for those management teams taking this time to prepare for when market conditions change.

Bringing together two worlds from my career – first, as a Wall Street equity analyst covering publicly traded stocks and, now, as a CFO of private growth companies – this intersection of private and public markets is one of the topics I intend to write about more.

When I was an equity analyst at Goldman Sachs, I recall one hedge fund client telling me that his Bloomberg terminal, where he tracked the share prices of his portfolio, provided a screen that told him how smart or dumb he was each second of the day.

My goal is to help companies on the path to going public use this time to develop a playbook that will build lasting partnerships with public investors by seeing:

- The faster pace at which investor expectations get set and reset in the public markets;

- That public market investors are fantastic partners and can see long-term but have to live in a shorter-term world;

- The new investor dynamics at play: a faster flow of information to command, more competition for investor attention, an investor base facing more pressure than ever to generate returns and the introduction of hostile investors; and

- There is a playbook they can develop including: driving a compelling growth narrative and practicing investor Q&A, getting good at giving guidance by being able to accurately forecast their business and being visible and accessible to show investors they are executing.

A SEA CHANGE IN INVESTOR ENGAGEMENT

Setting (and managing) investor expectations is one of the most critical roles at any company. There’s an art and science to setting compelling expectations (i.e., financial forecasts) that the company can meet or, better yet, exceed. “Beat and raise” is the best outcome for a public company when it reports financial results (i.e., reporting results that “beat” investor expectations and “raising” guidance for the next quarter or year ahead). This rhythm of setting and delivering on expectations is foundational to instilling confidence and building trust with investors. It’s this confidence and trust with investors that paves the way for a company to access new capital at attractive rates to fuel its ambitious growth plans.

Reaching unicorn status (a private company that’s valued at over $1 billion) and going public are incredible achievements. However, unicorns that go public have likely never experienced the pace at which investor expectations get set (or reset) in the public markets. Further, a unicorn will be at an additional disadvantage if its senior management team has spent recent years surrounded by a less critical pool of investors. A pool of investors who are their partners and who may not be pushing back in critical areas such as path to profitability and governance. Conversely, public market investors are shorter-term focused, under increasing pressure and relentless. I believe this sea change that a unicorn faces in investor engagement may be one of their biggest “hills to climb” when going public.

LIVING IN A SHORTER-TERM WORLD

When I was an equity analyst at Goldman Sachs, I recall one hedge fund client telling me that his Bloomberg terminal, where he tracked the share prices of his portfolio, provided a screen that told him how smart or dumb he was each second of the day.

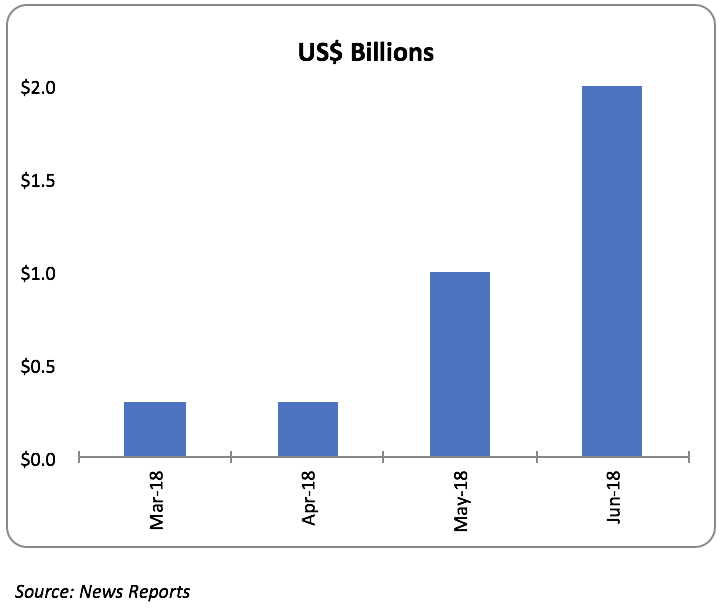

His comment stuck with me because I think it underscores the shift that private companies face when going public. A 24/7 news cycle leaves no shortage of news to move stock prices up and down. It’s not that he’s smart if his screen is green (showing share price gains) or dumb if it’s red (showing share price losses) at the end of the day. Rather, it’s that his Bloomberg terminal acts as a decision generator and each day it prompts him to make a decision around holding, adding to or selling his positions – and with the liquidity that public markets provide, it’s easier to sell when that decision is reached. In contrast, privately-held companies see their valuation change much less frequently and sometimes only after new investment rounds which can be months or quarters apart.

I think it’s critical for companies to see this tight rope they must walk. Public market investors are fantastic partners. I’ve seen them form lasting partnerships with innumerous management teams and successfully support multi-year growth plans. They can see long-term, however, they have to live in a shorter-term world. It’s not that they don’t have the capability to embrace a long-term vision. It’s that they get marked to market every day and, if they have a bad year, they may not be in their seat to see that long-term vision unfold.

NEW DYNAMICS AT PLAY

It’s worth underscoring some of the new investor dynamics at play for companies going public:

- A faster flow of information to command, not only from investors seeking a regular flow of information to support the company’s growth story and investor’s own investment thesis – but to the fast flow of extraneous data points from competitors, the market or 24/7 news cycle.

- More competition for investor attention given public market investors likely have other options to invest in fast growing companies. (However, I do think private companies are very interesting to public market investors as they go public as they hold a unique view on the industry that isn’t as widely disseminated as public companies.)

- An investor base facing more pressure than ever to generate returns as dollars allocated to active management decline (due to underperformance and higher fees) and more people move to inactive management (i.e., index funds).

- The introduction of hostile investors who have a platform to voice their displeasure. Activist investors build ownership positions to force change at a company while short sellers stand to benefit when the company’s stock price declines. They want the company to fail. Private companies have faced that from competitors but they’ve never faced it from an investor. Hostile investors may be most interested and active in companies where a majority of the shares outstanding are publicly traded where they can have a stronger influence.

DEVELOPING THE PLAYBOOK

While this set up can be daunting, I believe there is a playbook companies can begin to develop:

- Drive a compelling growth narrative, be in the driver’s seat as expectations are set and practice investor Q&A.

- Get good at giving guidance by being able to accurately forecast your business.

- Be visible and accessible and show investors you are executing.

Drive a compelling growth narrative, be in the driver’s seat as expectations are set and practice investor Q&A.

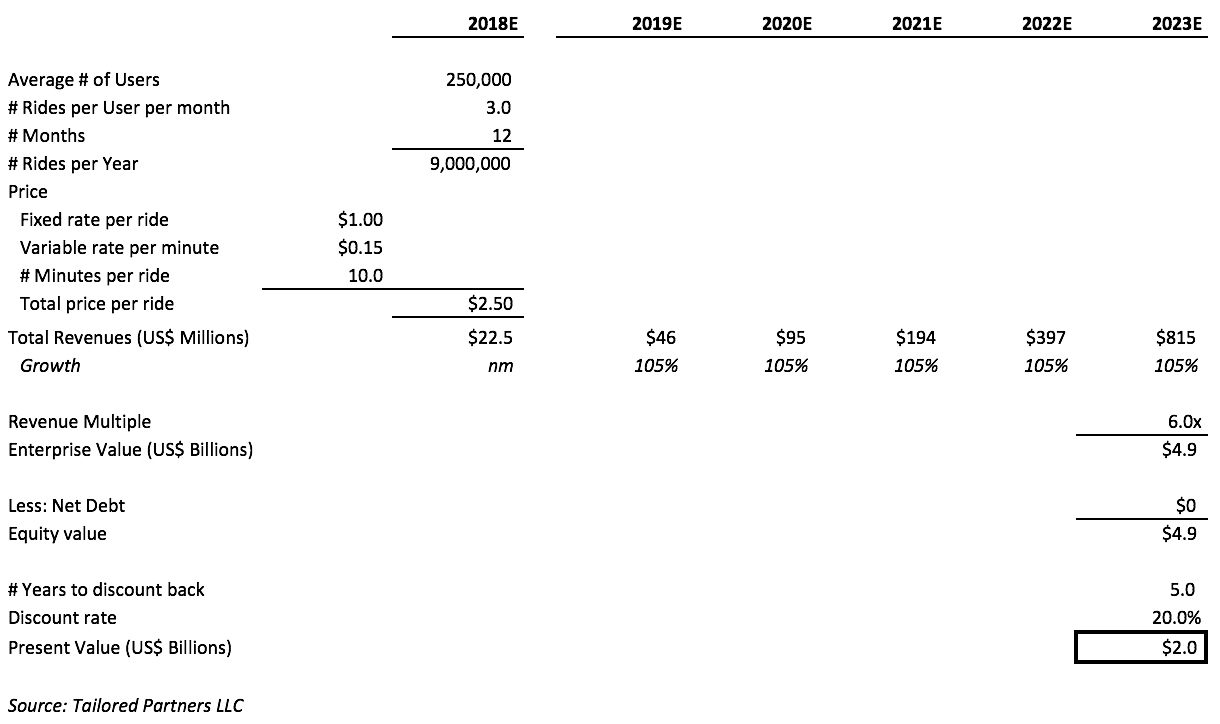

Drive a Compelling Growth Narrative: Public companies must drive a compelling growth narrative that excites and attracts investors. Without a strong narrative of growth drivers, a company’s stock price may flounder. Another way to think of it is story telling. The company should have someone on the team who can weave a strong, ongoing company story for investors. A story that envelops and captures why management chooses to do what it does at each step in the company’s journey. Choosing and repeating a good story (over and over on earnings calls, at conferences, at dinners), subtly adjusting the story when necessary and executing in alignment with the story will help the company build trust and help avoid catching investors by surprise when making moves. Part of the nuance here is that it’s important for a company to leave itself with enough room in the narrative to maneuver so that it doesn’t box itself into a corner and risk disappointment.

Be in the Driver’s Seat: I also think it’s critical for management teams to be in the driver’s seat as expectations are set for the company’s growth path and not let someone or something else control the narrative (bankers, analysts, investors, competitors, journalists, news events). For example, if a company going public wants to be grouped with a certain set of public peers that trade at a higher valuation (vs another adjacent sector that trades at a lower valuation), it should make sure those are the peers that management actively points investors to along with the compelling reasons why. Also, not every company provides guidance, however, by providing guidance, a management team leads in establishing the financial goalposts for the upcoming periods. While investors certainly form their own view, many track a lot of stocks and can often rely heavily on a company’s senior management to layout cornerstone benchmarks, show points of differentiation to competitors and provide an overarching growth narrative.

Practice Investor Q&A: In advance, management teams (and board members) should prepare for investor Q&A because it’s quite different than regular Q&A. Investors not only ask questions because they really want to know the answer to their question but they are also trying to validate a larger trend they perceive or, frankly, sometimes trying to get management to say something to move the stock one way or the other. In addition, there are many others listening (competitors, journalists, union representatives). Management should practice what to say and what not to say on a public conference call. In general, less is more and the glass should be half full rather than half empty. Investment bankers help with this kind of awareness during the IPO process but, after that, companies can find themselves more or less on their own to build and tell their story.

Get good at giving guidance by being able to accurately forecast your business.

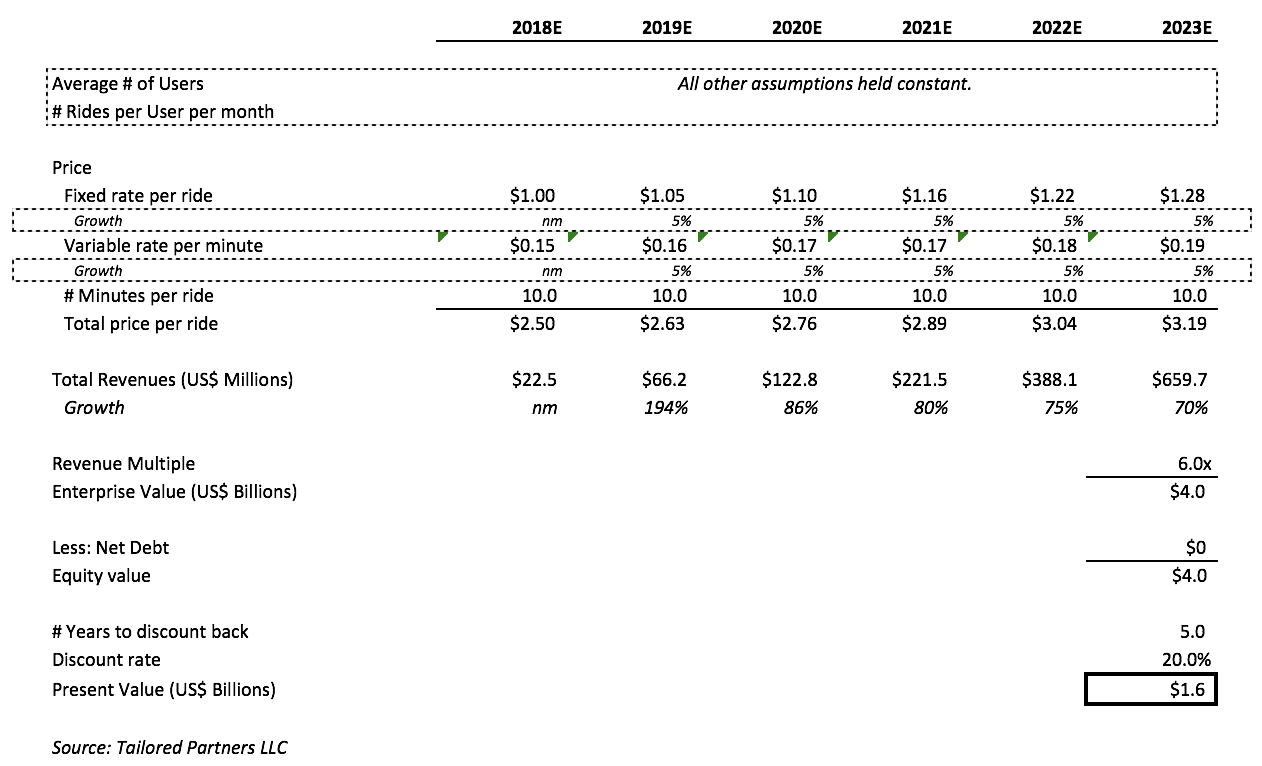

Forecast Accurately: One key way a company communicates its growth narrative is by providing guidance. Guidance is simply an estimate by the company of its future expected results. The way to instill confidence and build trust with investors is to deliver on or, even better, exceed their expectations. This is hard to always get right for sure; however, one foundational element to doing it well is an intimate understanding of and accurate ability to forecast your business. The confidence to hop in the driver’s seat as investor expectations are set, as mentioned above, will be rooted in being able to accurately forecast your business. No outside investor can model a business better than the company’s senior management team. So, a company needs to give its investors as much help as possible so there are not wild swings in expectations. While no company can accurately predict all the myriad of macro news trends happening globally, the more accurately they can forecast and communicate their own business, the more opportunities they will have to beat expectations and raise guidance.

Make an Honest Assessment: This is an area that a company shouldn’t rush and be prepared to make honest assessments regarding. As it prepares to go public, a company should practice and develop an internal scorecard to determine how accurate its forecasts are.

The First Experience: For companies that go public via IPO, their first experience will be as the offering share price is set. Companies face pressure to print a high IPO price to maximize valuation. The tradeoff is that this will also set sky-high investor expectations that the company will need to meet right out of the gates. I believe a balanced approach is essential. A management team should drive valuation by being the biggest believers in the company’s growth story. However, pushing too far can be shortsighted and backfire. If the company sets expectations that are too hard to meet post-IPO, then the stock will trade down below the IPO price. Now, the company is in the situation of being underperforming and a “failed” offering which will leave investors upset. If a company cannot even meet the expectations it set for its first results post-IPO, when it had ample time to prepare during the IPO process, then an investor’s confidence in the company’s ability to set and meet expectations in the future will be shaken. Very little stock can be sold in an IPO and where the stock trades in the future is more relevant to the company than the valuation of its initial offering. If management continues to be the biggest believers in the company’s growth story but comes out with a set of more realistic projections at the time of IPO which it can beat in the coming quarters, the stock should trade up making investors happy. An IPO is a one-time event and the actual IPO price has little relevance to the company’s long-term success. Comparatively, the company’s relationship with and perception from investors is long lasting.

Be visible and accessible and show investors you are executing.

Develop A Timely Cadence: Once a compelling set of growth drivers are communicated to investors and guidance is delivered, a company needs to actively support its narrative. Here, being visible and accessible are vital. The cadence may vary by company with some largely sticking to their quarterly result reports while others taking a more active route intra-quarter by speaking at investor conferences, hosting investor days or disseminating news releases with updates on key initiatives. I think companies should start with a happy medium – don’t just do quarterly calls and then disappear but rather find a cadence of quarterly calls plus several events to stay timely.

Execute & Get Credit: Regardless of the precise rhythm, a company needs to drive home their growth story by thoughtfully providing investors with supporting and confirming information and results. Once a company tells its investors what they are going to do, then they need to show them that they are doing it. It’s just as important to spell things out clearly to investors along the way in order to get credit. If investors can’t feel confident their thesis is on track, they may not stick around.

SEIZING THE OPPORTUNITY

I mentioned earlier the long-term vs. short-term tight rope that I think companies must walk. I believe unicorns that go public can still play a long game, casting a huge, disruptive vision that will change the world. This is the type of compelling growth narrative that will excite and attract investors. Now, though, it needs to be distilled and supported in shorter increments by a management team that’s developed their playbook to weave a compelling story, forecast the business accurately, handle investor Q&A, stay in command of the flow of information and be consistently engaged to show they’re executing!

Copyright 2023 Neil Portus | Please see our disclaimers.