Visit our store to download a free copy of this presentation on “How to Value a Startup.”

This article was featured on the Autonomy.Paris Urban Mobility Daily newsletter.

This year’s Autonomy & Urban Mobility Summit and companion Funding the Movement program provided a strong focus on up-and-coming mobility startups with over 120 early-stage companies attending, pitching or exhibiting.

With this focus on emerging companies and disruptive technology, I was invited to speak at the conference on “How to Value a Startup” in order to walk mobility innovators, policy makers and industry experts through my four-question valuation framework for a startup: (1) What are comparable companies worth? (2) What is the investor’s target return? (3) How viable is the customer acquisition strategy? and (4) Are expectations set too high?

Below are key highlights from my talk but be sure to visit our store to download a free copy of the full 75-slide presentation. I wrote it with a lot of detail and examples so it could be a helpful resource to those unable to attend in-person.

Key Highlights – How to Value a Startup

In speaking on startup valuation, it’s helpful to lay a bit of groundwork. Valuing companies is not easy as information is limited and fragmented. This is why investors frequently employ The Mosaic Theory which is a research approach whereby one arrives at an asset value by piecing together bits of available information. My perspective is that, if done in isolation, two people can often come up with a different valuation for a company. For an investor who has an in-depth understanding of a specific industry or sector, this limited availability and fragmentation of information is often what can provide them the edge to garner an outsized return on investment.

Additionally, valuation is only one of the key investment factors considered by early-stage investors. In my view, the quantitative and qualitative factors at play include:

- Quantitative:

- Revenue growth;

- Customer churn;

- Barriers to entry;

- Market size/potential; and

- Valuation.

- Qualitative:

- Strength of the management team; and

- Uniqueness/long-term sustainability of the business idea.

With that groundwork set, I value startups by answering four questions:

1) What are comparable companies worth?

2) What is the investor’s target return?

3) How viable is the customer acquisition strategy?

4) Are expectations set too high?

The first two questions are more quantitative while the second two questions are more qualitative.

(1) What are comparable companies worth?

In this first step, we want to determine what other investors have paid for comparable businesses. A comparable business (sometimes called a “comp” or “comps” when referring to the whole peer group) is one that shares the same or similar: (a) industry, sector or subsector; (b) geography; (c) business model and/or revenue model; and (d) growth rate. Here, you don’t have to tick every box but you want to tick a lot of them. The reason “comps” are important is that investors often give the “market” credit that it broadly knows what it’s doing. So, the starting point for an investor is often what another investor has recently paid for something similar.

Selecting the peer group of comparable companies is the critical step. I generally see three paths based on the amount of information available:

- Path 1: There are publicly traded comparable companies where a good amount of information is available; in the presentation, I walk through an example for luxury carmaker Aston Martin.

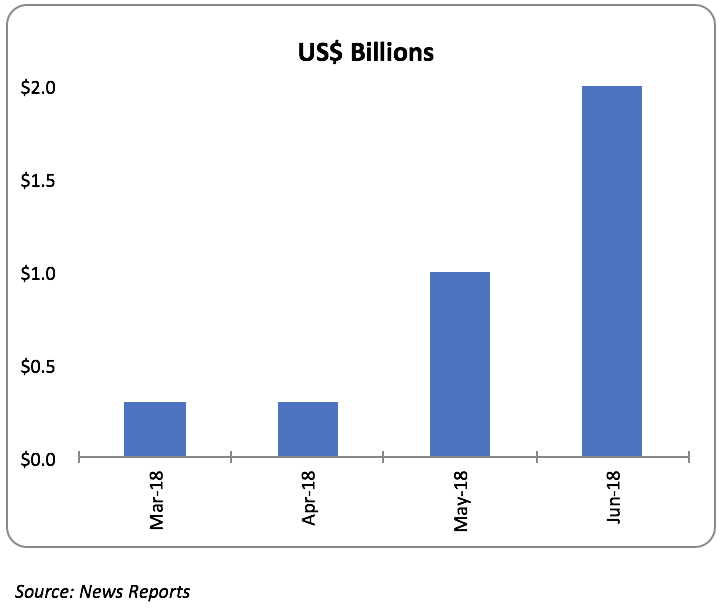

- Path 2: There is a limited amount of information available for private comparable companies available through news reports and press releases; in the presentation, I walk through an example for Lyft and Uber.

- Path 3: There is almost no information available from private comparable companies; in the presentation, I walk through an example for peer-to-peer car sharing startups comparable to Turo or Getaround.

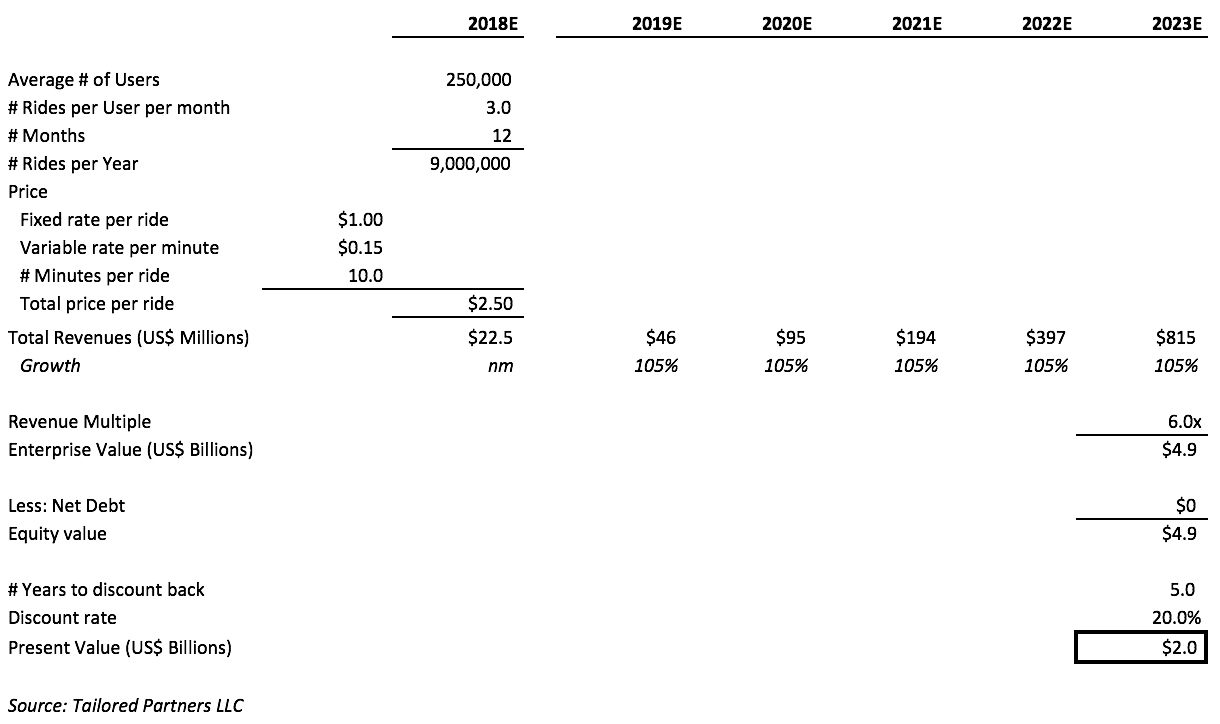

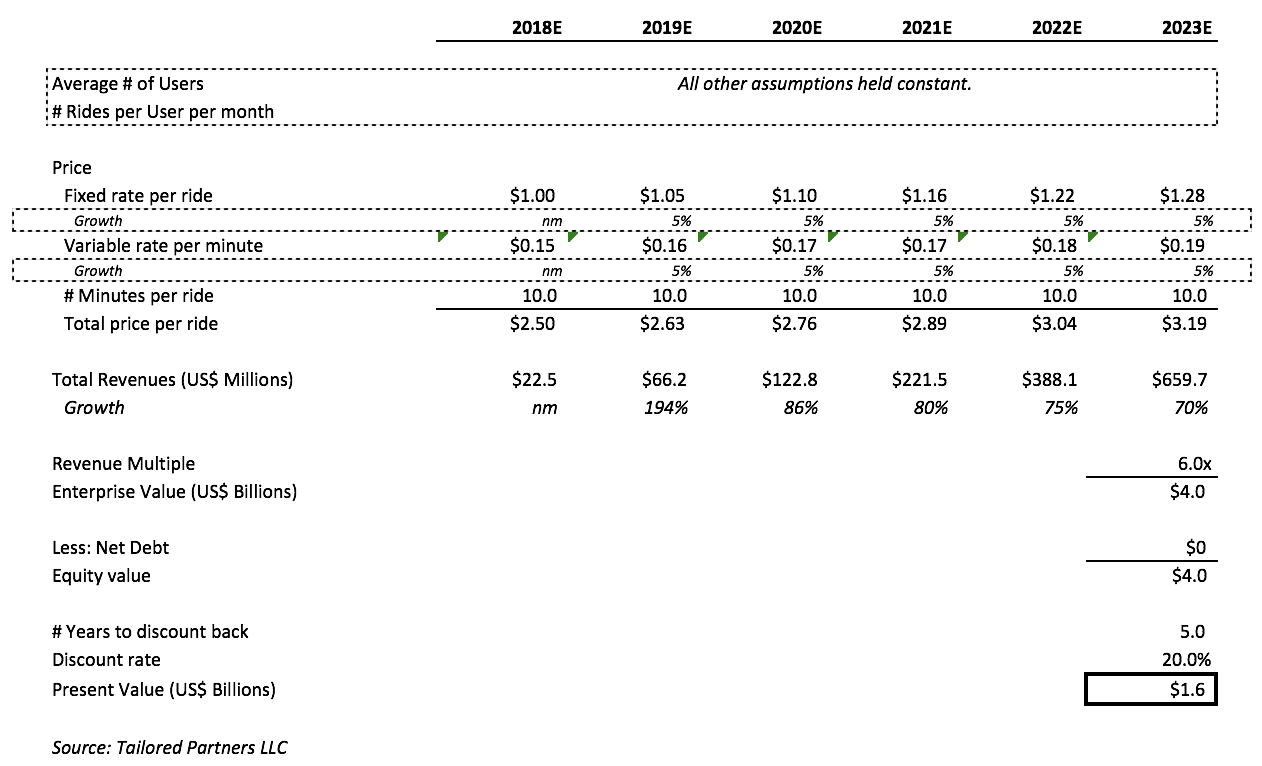

For startups, investors will primarily focus on revenue growth as they want to know how big can this startup get. As a result, investors will generally value startups using a revenue multiple. As companies mature, investors will increasingly focus on profit growth. Here, investors start to look at multiples of cash flow or net income/earnings per share.

In my work with startup founders, I’ve found that one of the more helpful takeaways for them is that they can have an active voice in which companies comprise their peer group. Perhaps they are in an emerging sector with few existing, comparable companies or perhaps they believe their company has a disruptive technological or delivery angle which warrants a premium to other companies in the marketplace. Founders can influence valuation by identifying and supporting a peer set of comparable companies with more attractive valuations.

Once investors derive a revenue multiple from a peer group of comparable companies, they may adjust it higher or lower based on several factors. Potential discounts include if the startup is growing at a slower rate than peers as well as for a lack of liquidity if a set of public comparable companies is used to value a private company. Potential premiums include if the startup is growing faster, it may warrant a higher multiple than peers.

(2) What is the investor’s target return?

Given the risk profile of early-stage companies, investors frequently come to the table with a high bar for their target return. The question is, if private equity investors (who invest in more mature, private companies) often target a 3X return, how does an early stage investor achieve a similar return if +50% of startups fail?

Since a lot of startups fail, investors need the ones that succeed to do really well. So, for example, an early stage investor who targets a 10X return on each investment will achieve a 5X return on their portfolio if half of the companies fail.

An investor will receive an increased ownership stake in the startup for the same dollars invested as the valuation decreases. The net result is that an investor’s higher target return (i.e. 10X) can put a cap on the round’s valuation multiple.

In the presentation, I walk through a detailed example as to how an investor would calculate a 10X return and how this might result in a cap on the valuation multiple.

(3) How viable is the customer acquisition strategy?

This begins the more qualitative third and fourth questions in my framework.

Here, I seek to understand what can the startup provide to support its growth profile because, without meaningful support, I believe investors will be skeptical. A couple of key questions I ask include:

- Is someone on the team experienced in leading customer acquisition?

- Do they have a measurable and thought-out process – i.e. a multi-step process to identify leads, qualify them and then turn them into potential opportunities and, finally, customers?

Next, I want to be sure the economics make sense by exploring key questions such as:

- What will they spend to acquire each new customer?

- How valuable is each new customer they are acquiring?

- What supporting data do they have?

I find that it’s hard not to land at looking for some type of Customer Lifetime Value (LTV) to Customer Acquisition Cost (CAC) analysis. While a LTV to CAC analysis is often used for a unit economic analysis for Software-as-a-Service (SaaS) businesses, I’ve seen it effectively applied across many industries. In the presentation, I walk through a high-level LTV to CAC example.

(4) Are expectations set too high?

With this fourth question, I try to gain a sense of whether I think the startup will beat or miss the operational milestones they are laying out in their investor deck, including:

- Revenue targets and/or sales goals;

- Number of users;

- Number of cities they enter;

- Number partnerships they develop;

- When they turn profitable; and

- Number of employees they can hire to scale.

Key questions I will ask include:

- Can this team execute?

- What about the team’s history of delivering on expectations?

- Do they have a track record – i.e., are they second or third time founders?

Expectations are important because, simply put, if you miss them, investors will lose confidence. Conversely, if you beat expectations, investors will gain confidence. There is reputation risk if a startup misses expectations materially or repeatedly in that the next investment round may be a down round at a lower valuation or the startup won’t be able to raise funding at all.

It’s a startup founder’s role to “manage expectations” and walk the tightrope of being aspirational with the company’s vision and goals while not setting them too high that they routinely miss them.

Conclusion: How do we apply all of this?

For a startup founder, I find that the “comp set” derived through question #1 often reflects their ideal valuation multiple while, for an investor, their target return derived in question #2 can cap the valuation at a lower multiple. In this scenario, my view is that the founder’s multiple can be the ceiling while the investor’s multiple can be the floor for the valuation conversation. Then, the more compelling the answers are to question #3 (How viable is the customer acquisition strategy?) and question #4 (Are expectations set too high?), the more likely investor demand will rise lifting the round’s valuation multiple towards the ceiling. Without compelling answers, valuation will be pressured down or the round won’t get done at all.

Copyright 2018 Neil Portus | Please see our disclaimers.