This article was featured on the Autonomy.Paris Urban Mobility Daily newsletter.

Covid-19 and the shelter-in-place orders that followed have forced many of us to work from home, popularizing the #WFH hashtag. Virtually every role at every company has been affected as a result.

One role in particular that has seen tremendous impact is that of business development. The familiar ways of developing and closing on new business have vanished: in-person meetings, networking events, trade shows and conferences. A phone or video call used to only be the initial set up to an in-person meeting.

With so many businesses retrenching and cutting costs, for those of us working from home who are fortunate enough to be safe and healthy, taking this time of self-isolation to actively plan for the future and new ways of generating income is very top of mind.

However, the old playbook will not work. In fact, striking the wrong chord may cause more harm than good. Personally, I’ve seen more #Fails than #Wins from the outreach emails I’ve received during this time from communication that ignores our current state or pushes a product that’s currently irrelevant. Business development in this time can be daunting.

That said, new opportunities will emerge. There may be a new normal but there will be opportunities to do good work and build and sell good products. Mobility, as much as any other industry, is facing massive disruption which will lead to new innovation.

So, with all of this opportunity ahead, how does one thoughtfully think about business development in 2020?

I wanted to share my personal framework which is based on “Bacon’s Law” stemming from folklore surrounding the American actor, Kevin Bacon. The basic idea is that you are connected to any other person on Earth through six or fewer people. It’s this concept that I think applies to business development during and emerging from Covid-19 (and I think can also apply to anyone job searching in this time). Here’s how I see it:

0 Degrees of Seperation: Start with Who You Know

These are the people you already know simply put. The people you have met or, better yet, worked with before. These connections are formed and you can pick things up with a phone or video call. Even better, many of them probably want to hear from you during these isolating times! This group is your best bet to form something new and move forward. I would be reaching out and checking in with this group and exhausting all possibilities before moving forward anywhere else.

1 to 2 Degrees of Separation: Showcasing the Urban Mobility Challenge

Looking beyond your “0 Degree” contacts has potential but it’s worth proceeding cautiously.

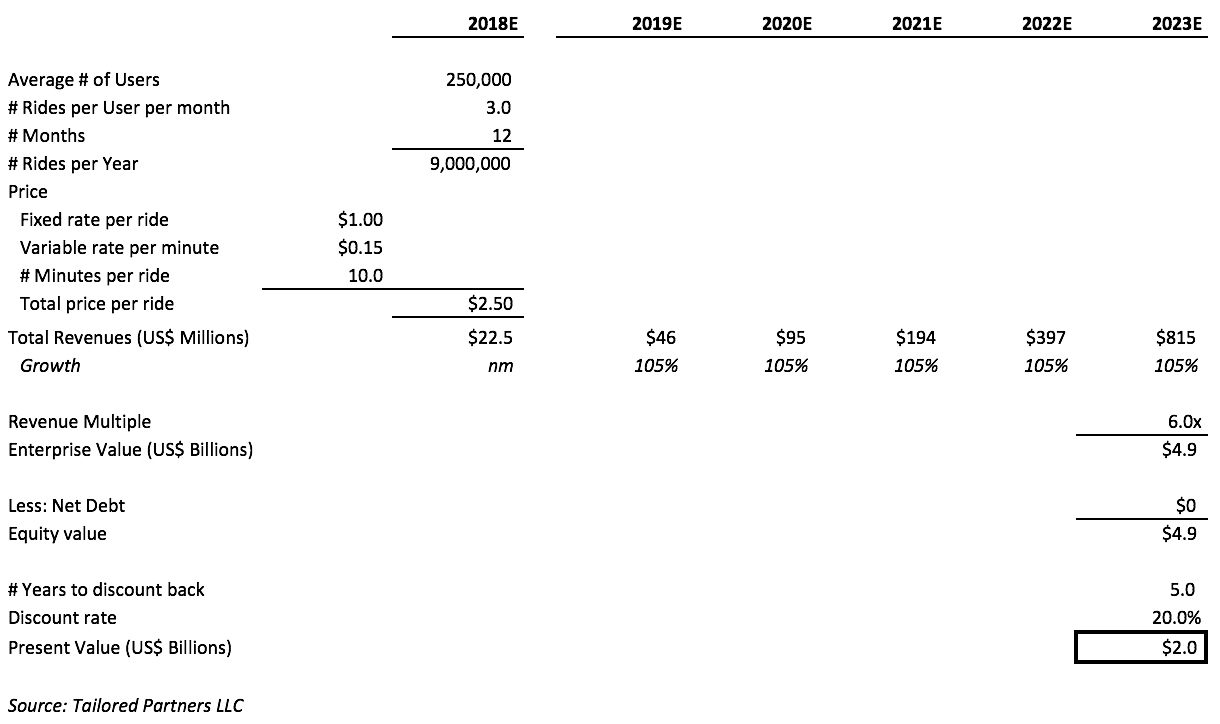

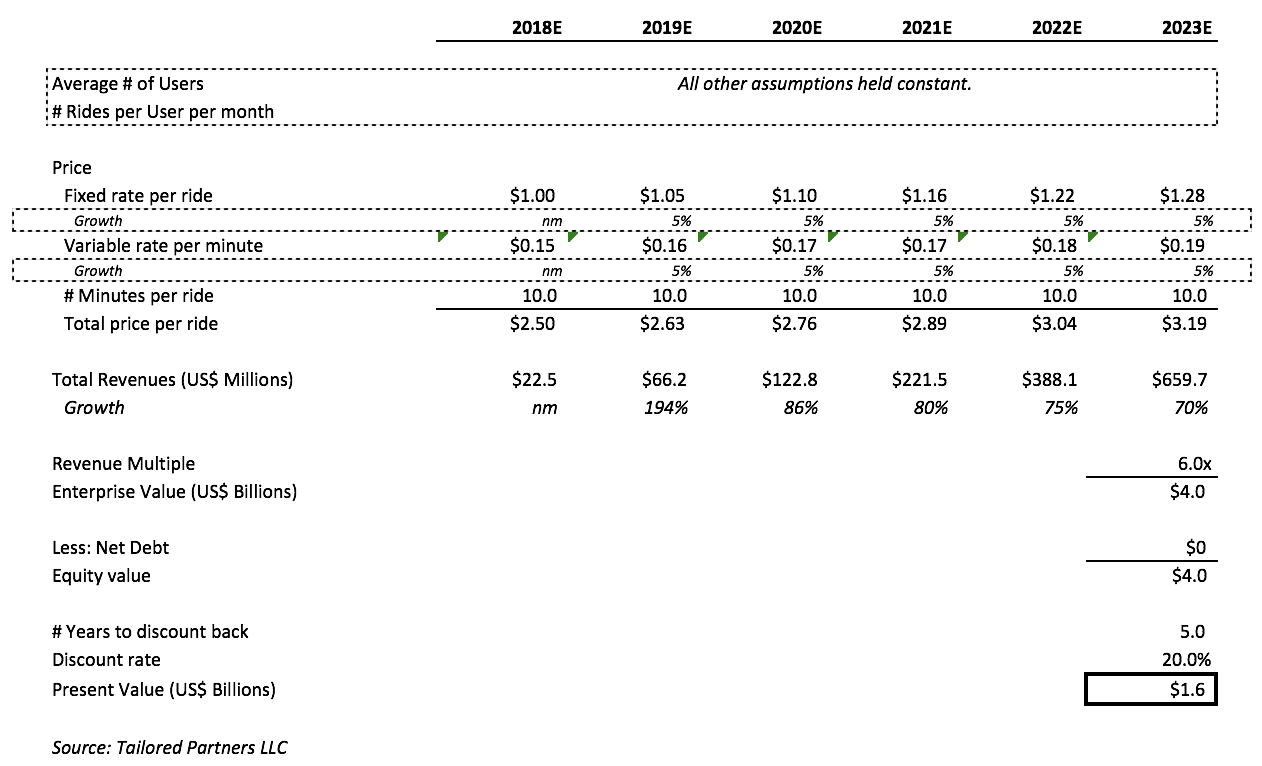

My first thought is to approach your closest “0 Degree” connections for referrals and introductions. For my own CFO-services consulting business, Tailored Partners, referrals have been my greatest source of new clients. I expect that to continue in 2020.

However, there may come a time when you’ve exhausted your “0 Degree” connections and their potential for introductions and referrals. This is where I believe something innovative like the Urban Mobility Challenge comes into play and is worth showcasing as a prototype.

Just launched by the Urban Mobility Company and inaugurated by the Nissan Innovation Lab, the all-digital Urban Mobility Challenge is an example of an offering well suited for any time – but certainly uniquely well positioned for business development in 2020.

Briefly, the Urban Mobility Challenge is a 3-step program designed to allow companies to quickly discover, meet and select the most innovative startups with which to develop a proof of concept. It’s a digital funnel which provides exclusive access to Autonomy’s community of +10,000 startups from around the world. The Urban Mobility Company takes care of everything from beginning to the end and all pitch sessions and meetings are done virtually. Further, corporate partners and winning startups will be promoted through content pieces distributed to the Urban Mobility Company’s audience of more than 10,000 professionals via its digital content platforms the Urban Mobility Daily and the Urban Mobility Weekly and showcased at Autonomy 2020’s Startup District this November 4-5, 2020.

I think the value proposition is compelling. You can access and leverage Autonomy’s entire ecosystem, which has taken years and millions of Euros to build, in a span of weeks and for a relatively lower cost. For many companies, I think that will be a valuable trade (and perhaps covered not through new spend but by repurposing existing budget that may be underutilized or not used).

Further, the startups you meet may be more eager than you to connect as they too are seeking new partnerships in this time. You know Autonomy, they know Autonomy and you can both leverage the trust in that relationship to build something new together. It seems like the ingredients for a win-win outcome.

3-6 Degrees of Separation: Content is King

Looking out to contacts that are 3-6 degrees of separation away, personally, I think the best way to reach and engage this group will be through creating and distributing valuable content.

In-bound communication from a person or company you don’t know is a quick delete and unsubscribe for me right now.

However, new content that solves a problem or addresses something of interest is king. Cash is king they say. That certainly is still true today but perhaps we can also say that content is king too.

The most valuable content to me right now is that which I’ve sought out and solves a problem for me. I think that content which meets an interest or need is going to win new attention which can translate into new business. People are looking for solutions and, if you can provide that, you will be winning new customers.

It’s worth noting that the Urban Mobility Challenge’s value proposition extends here to 3-6 degrees of separation through its co-creation of relevant content and distribution through the Urban Mobility Daily & Weekly channels, vastly expanding the reach of your group of 3-6 degree contacts.

Copyright 2020 Neil Portus | Please see our disclaimers.